U.S. Electrical Services Market Outlook 2025 and Beyond

.webp?updatedAt=1754640117677)

U.S. Electrical Services Market Size

The U.S. electrical services market isn’t about flipping a few switches in the electrical panel anymore. It is expected that the US electrical services inc. market will be worth 294.6 billion dollars in 2034. In short, the electrical services market provides a decade-long, uninterrupted growth opportunity for businesses.

Two big reasons are driving this upward curve: serious federal investment to upgrade the outdated grid, and growing demand for clean, smart, and energy-efficient systems in homes and businesses. Throw in commercial developments, EV charging stations, and infrastructure revamps, and you've got a sector that’s buzzing with activity.

It’s not just one type of service making up the numbers either. The industry breaks down into key segments:

-

Electrical construction alone is estimated to be worth more than the 115 billion mark for 2024. This sub-sector includes new constructions, grid connections, and large clean energy systems.

-

The maintenance and repair services have historically boosted the value of the market. In 2024 alone, the maintenance and repair services sector is expected to generate over 20 billion dollars, keeping systems in good order, the lights on, and everything in between.

The growth in both scale and complexity is welcomed by US electric contractors and US Electrical Services Inc. providers because they are poised to benefit from industry growth opportunities. The best part? This growth isn’t just for the big guys. Whether you’re a seasoned electrical contractor, a local electrical services provider, or just thinking about starting an electrical business, there’s room for you in this boom.

U.S. Electrical Industry Trends

The electrical services industry in the US is undergoing noticeable advancements. From 2025 and beyond, the focus shifts from simple wiring to the construction of advanced and automated cleaner energy buildings, which are in sync with the fast-paced global technology.

1. Grid Modernization and Smart Grids

Outdated grids are getting replaced with real-time monitoring, digital substations, and automated response systems. These enhancements make the grid more adaptable, reliable, and primed for renewable energy integration.

2. Electric Vehicles and Clean Energy

EVs and solar are now part of everyday life. The integration of EVs and solar into the electrical infrastructure necessitates the construction of new charging systems and battery systems. There is an increased need for skilled US electric contractors capable of high-voltage installations and energy integration.

3. Prefabrication and Modular Builds

Due to strict timelines and escalating costs, electrical contractors are moving more work off-site, than in the field. This includes work such as pre-wired panels, conduit assemblies, and modular components to be installed. This helps to smooth and streamline job site operations.

4. Smart Buildings and Energy Efficiency

Modern homes and commercial buildings embrace automation. Smart lighting, energy dashboards, and HVAC systems that respond to occupancy are standard. All of these systems require professional US electrical services for safe and proper installation.

5. Resilience and Backup Power

There is now a greater need for advanced electrical infrastructure due to extreme weather. In response, contractors are employing advanced grid automation, dynamic line sensors, energy storage systems, and automated controls to enhance grid performance and protect against outages.

6. Federal Investment and Long-Term Growth

The U.S. government is funding a massive transformation of the national power grid. Billions are allocated toward electrification, hardening the grid, and establishing EV infrastructure. That means job stability and long-term service contracts for businesses in the electrical services space.

For electrical contractors, business service providers, and all stakeholders in the U.S. electrical industry, this serves as more than a mere prediction report. This serves as an indication that this sector is rapidly evolving and rewarding those who can evolve with it.

.webp?updatedAt=1754640117463)

U.S. Electrical Services Market Analysis

Let us further analyze this market to identify the sources driving that growth. The U.S. electrical services industry is not only growing in size, but also in scope. It’s branching out in all directions. Whether you are wiring a high-rise or tuning the sensors in a manufacturing plant, there is a proliferation of multiple service types and customer categories.

By Service Type

Not all electrical work is created equal. Here’s how the services stack up:

-

Electrical construction is the biggest player In 2024, this segment brought in over $115 billion. This includes grid hookups for clean energy, wiring new buildings, and everything in between. Most of the big-budget projects are in this segment.

-

Instrumentation and technical services handle the sophisticated stuff. Think testing, calibration, integration, and tech-heavy maintenance. This segment is poised to earn over $34 billion by 2034. As more systems are developed, demand for these specialized services keeps climbing.

-

Maintenance and repair may not grab headlines, but they keep the power on. This segment passed the $20 billion mark in 2024. It covers routine checks, emergency repairs, and post-storm recovery work. As systems increase in complexity, so does the importance of maintenance and repair.

.webp?updatedAt=1754640116841)

By Application

Now for the who’s who of the industry. Here’s where the services are being used:

-

The utility sector constitutes the heavyweight This group of power companies and grid operators accounts for nearly half the total market. Due to sizable spending on grid enhancement, this sector is predicted to exceed $135 billion by 2034.

-

The industrial sector includes plants, refineries, and automated assembly lines. From high voltage installs to smart sensors, industrial demand keeps rising as technology in factories fuels their energy appetite.

-

Commercial sector rounds out the list with hospitals, schools, offices, and retail buildings. Valued at around $25 billion in 2024, it continues to grow thanks to modern tech upgrades and sustainability pushes across urban and suburban developments.

All segments contribute to and shift the industry into forward gears. Whether your focus is on utility, industrial, or commercial structures, there’s no shortage of opportunity across the board.

U.S. Electrical Services Market Share

Let’s talk about who’s running the show. While thousands of electrical contractors operate across the U.S., a small group is pulling in a large share of the revenue.

The dominant five players in the industry hold a staggering market share of almost 45 percent. This implies that almost 50% of the electrical servicing revenue in the country is concentrated with a handful of companies. These firms aren’t just big on paper. They’re the go-to players for utility upgrades, large-scale installations, and nationwide projects that smaller competitive firms rarely get a shot at.

Here’s a closer look at some of the big names:

-

APi Group is a well-known name in the industry as a general contractor. It has its core services in safety services, life services, and electric services. It has been on a growth streak as it has been acquiring more niche service providers and expanding its presence in the building services One of its core strategies is to bring in more recurring revenue from service contracts rather than relying on one-off construction jobs.

-

Quanta Services focuses heavily on grid modernization and renewable energy integration. From utility-scale solar farms to high-voltage transmission lines, Quanta is often the name behind the curtain on major infrastructure builds.

-

EMCOR Group has established a noteworthy mark in commercial and industrial electrical contracting. With a mix of construction and maintenance expertise, EMCOR can take on everything from data center wiring to industrial system upgrades.

-

MYR Group and MasTec complete the list with a strong presence in commercial, transmission, and distribution, and large-scale projects. MasTec, in particular, has expanded from telecom into energy and electrical contracting, making it a versatile industry player. That said, the rest of the market remains far from irrelevant. Niche and regional contractors still make up over half the business. These companies often succeed by providing local customer service, specialized services, or performing rapid turnaround jobs which the industry giants avoid.

In short, it’s a two-track market. The big players dominate the mega-projects, while smaller firms win on speed, specialization, and service.

Ready to get started with Field Promax?

Sign Up FreeU.S. Electrical Services Market Companies

Now that we know who’s grabbing the biggest slice of the market, let’s zoom in on how they’re making it happen. There is no denying that the major players in the U.S. electrical services industry aren’t just holding market share. They’re constantly expanding, acquiring, and adapting to stay ahead.

-

APi Group raked in $5.2 billion in the first nine months of 2024 alone. Most of that came from its building services and life safety division, which brought in $3.8 billion. The company is pushing hard toward a service-heavy model. Its goal is to make at least 60 percent of its revenue from recurring contracts instead of chasing one-time projects. To get there faster, it snapped up Elevated Facility Services for $570 million, adding elevator and escalator maintenance to its lineup.

-

EMCOR Group topped $10.8 billion in 2024 revenue. The company keeps expanding through strategic acquisitions. A big one came in January 2025, when it acquired Miller Electric for $865 million. That deal gave EMCOR a stronger grip on commercial and tech-sector electrical work, not to mention a deep bench of skilled electricians.

-

MMR Group may not be a household name, but it’s making waves in industrial electrical work. The company pulled in $1.4 billion in 2023 and climbed to number nine on the U.S. electrical contractor list. Its focus on petrochemical, energy, and instrumentation projects keeps it competitive in some of the most demanding environments.

-

U.S. Electrical Services, Inc. (USESI) doesn’t install systems. It supplies the gear. As one of the largest electrical supply distributors in the country, USESI supports contractors with over 150 locations and a huge catalog of products. Without companies like USESI, even the best electrical service providers would be dead in the water when supplies run low.

Together, these companies represent the different ways to win in the electrical services industry. Some dominate through size and scope. Others find success in specialization or strategic acquisitions. But what they all have in common is the ability to adapt to the fast-changing demands of the electrical world.

U.S. Electrical Services Industry News

If you thought the electrical services space was just cables and circuit breakers, think again. Behind the scenes, this industry is buzzing with major deals, strategic acquisitions, and growth plays that are reshaping the landscape.

-

Quanta Services acquired Cupertino Electric in July 2024. Cupertino was already a big name in the California market, known for its expertise in tech infrastructure and renewable energy projects. With this move, Quanta expanded both its geographic reach and its capabilities in clean energy and large-scale data center projects.

-

EMCOR Group bought Miller Electric in January 2025 for $865 million. Miller has been around for over a century and brings deep experience in commercial, industrial, and government projects. The acquisition gave EMCOR a broader range of capabilities and a stronger position in sectors like healthcare and education.

-

APi Group picked up Elevated Facility Services for $570 million in April 2024. That added elevator and escalator maintenance to APi’s toolkit and helped round out its building services lineup. It’s part of a bigger push to move toward recurring revenue and bundled service offerings.

-

Redwood Services is building a residential empire Rather than chasing mega contracts, Redwood is investing in established local providers across the country. In 2024, it partnered with names like Parks Heating Cooling, Plumbing & Electrical, and Crisafulli Bros. The strategy is to help these businesses scale while keeping their well-earned community trust intact.

All signs point in the same direction. The industry is consolidating, diversifying, and scaling at speed.

Whether it's a billion-dollar grid upgrade or a family-run electrical business going national, the playbook is growth, flexibility, and long-term resilience.

Conclusion

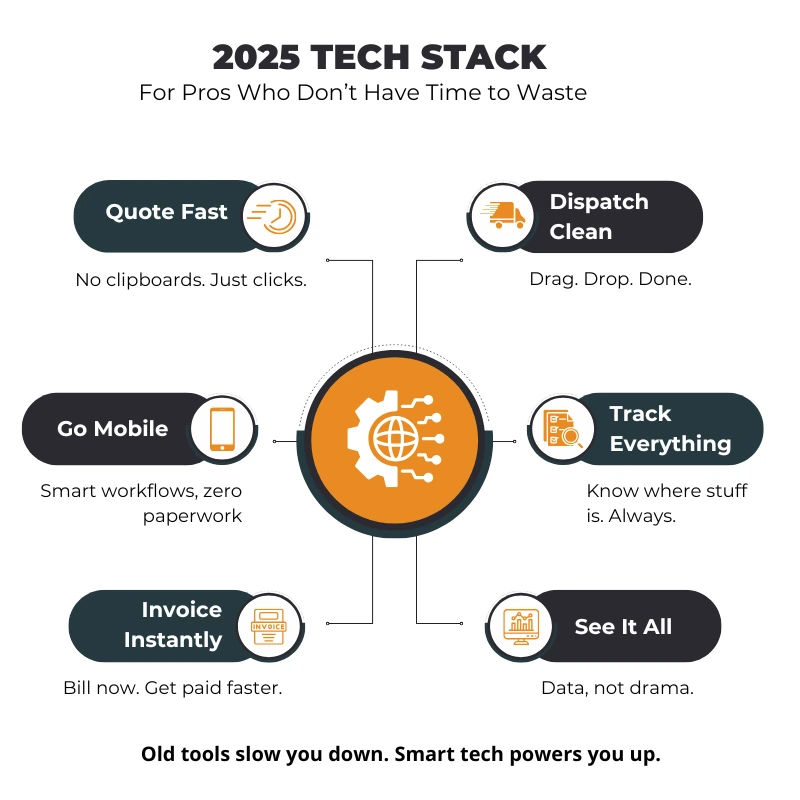

The U.S. electrical services market is charging forward, and field service professionals are right in the thick of it. As demand rises across utilities, commercial buildings, and clean energy projects. Electrical contractors need software tools to stay in control, not just skills.

This is where Field Promax steps in. It simplifies scheduling, dispatching, estimating, and invoicing, helping electrical service providers stay organized and efficient. It's designed for the field and built to support real business growth.

.webp?updatedAt=1747733768875)

In a fast-moving industry where reliability and speed matter, the right field service software is not just helpful, it’s essential. Electrical software gives you the clarity and tools to keep your operations sharp and your customers satisfied.