Benefits of QuickBooks Online: Why QuickBooks is Good for Contractors

QuickBooks Online is a great choice for a variety of field industries. It enables you to manage the various components of a business, from estimate development to team cooperation and work cost reports. But is it a good choice for contractors?

The answer is yes! QuickBooks for contractors is not just good, but a great choice when it comes to accounting software.

As a contractor, you understand how difficult it can be to maintain order and make sound financial decisions while also managing your business. And here is where QuickBooks Online shines as a valuable resource for contractors. From tiny handyman businesses to major commercial jobs, the program includes a variety of user-friendly features to help your business function smoothly.

If you have not tried QuickBooks Online yet, this blog is for you. Here you will find everything you need to know about this popular accounting software, and we hope it is more than enough to help you make up your mind.

So without further ado, let’s dive in.

Ready to get started with Field Promax?

Sign Up FreeWhat is QuickBooks Online?

QuickBooks is a popular accounting software for businesses. It can be the ideal solution without burning a hole in your pocket if you want to move away from manual bookkeeping, your spreadsheets have turned into a multi-headed hydra, or you need a better option than your existing software. It offers a range of accounting solutions, and QuickBooks Online is one of the most sought after products among them. With QuickBooks Online, you can store your accounting records in the cloud and view them from anywhere at any time. It is accessible from computers, smartphones, and tablets. QuickBooks Online also has invoicing capabilities.

QuickBooks is one of the best accounting solutions for small businesses, and it’s a terrific place to start toward an organized accounting system for contractors just starting out. While it is not particularly intended for construction, it is intended to be useful for a variety of businesses.

As a result, contractors continue to reap the rewards of using QuickBooks Online for contractors. Of course, the amount varies. But overall, it is indeed an efficient tool to enhance your bookkeeping and accounting tasks, as well as improve your business processes for better productivity.

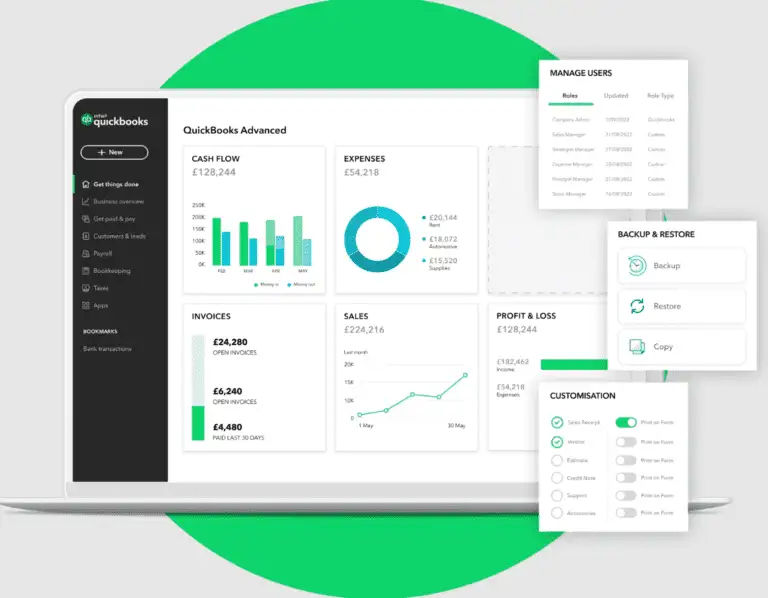

Core Features of QuickBooks Online

QuickBooks Online comes with some amazing features to help your business grow.

Cloud Accounting

Manage your business, access your account, and stay organized from any computer, mobile device, or tablet.

Cash Flow Management

Enter vendor bills and pay them only when they are due. To save time, set up recurrent payments to automatically pay them on time.

Time-Tracking

Clock employee time and total billable hours for accurate payroll. Track total billable hours for clients and add them to final invoices automatically.

Multiple Users

Control your accounts and books with enhanced security made possible by defined roles and permissions. Invite your accountant and bookkeeper to access information for improved collaboration.

Mobile Access

QuickBooks Online offers an integrated mobile app with your subscription so that you can access information from anywhere using your smartphone or tablet.

Reports and Analysis

See how your business is performing with real-time analytic data with customizable reports and dashboards, and make informed decisions to make your business more efficient.

Best-in-Class Support

Post-sales and onboarding support is available for free. Get all your questions answered and your concerns addressed whenever you need them.

What’s New: Online Banking

QuickBooks Online now features online banking. This cutting-edge banking integration feature automatically updates your banking statements and transactions.

Benefits of Using QuickBooks for Construction Companies

Here is why it is a good idea to use QuickBooks for construction companies:

1. Easy to Use

One of the most appealing aspects of QuickBooks Online for construction contractors is its ease of use. Of course, this is dependent on the range of features and alternatives offered. However, basic invoice entry can be extremely simple, and linking your QuickBooks Online account to bank accounts can make importing transactions a breeze. Some customization options also allow you to customize major reports, so you can experiment with them and save them for later.

This essentially means that you don’t need good accounting experience to utilize QuickBooks properly. Don’t understand the difference between “credits” and “debits”? That’s OK. The easy entry windows, like in a lot of other accounting software solutions, handle most of that for you. Aside from delving into some of the more advanced features, such as adjusting your journal entries or integrating third-party apps, you shouldn’t need much prior knowledge to get minimal value.

2. Cloud Accounting

QuickBooks has just transitioned its users to a fully cloud-based accounting platform. That is, you can access it from anywhere there is an Internet connection. That could be your office desktop or the brand-new laptop you just purchased. There are no downloads or installations with cloud software.

Of course, another advantage of using the cloud is that backups are handled automatically, and the servers on which your software runs are professionally guarded. Using QuickBooks, contractors can really benefit from this feature.

Want a personalized demo?

See how Field Promax can transform your field operations

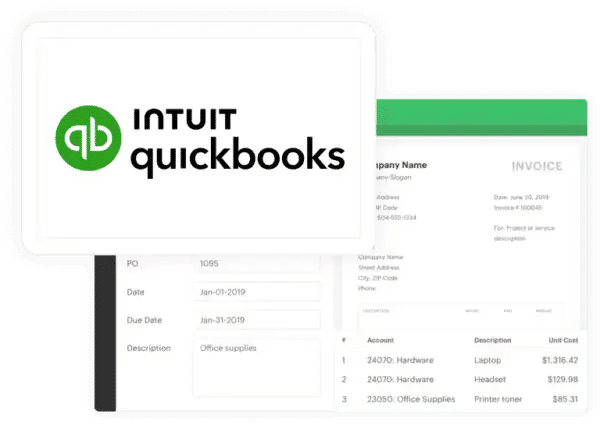

3. Billing and Invoicing

Receiving payment on time is one of the most difficult challenges for a general contractor. Ask any contractor, and they will have at least one horror story about not receiving payment even six months after completing a task, or worse, not at all!

But if you use QuickBooks for construction businesses, you won’t have that difficulty. Because the software automatically generates your invoice receipt template and bids, allows you to send them directly to the customer (even in the field), and helps you get paid on time.

The best thing about QuickBooks Online is that the invoices have a professional appearance. This not only makes your company look reliable, but it also increases your business’s credibility and attracts more potential consumers.

4. Estimation for Construction Projects

When it comes to executing a construction project, it’s critical to estimate both the cost and the length of time the job will take.

If you charge your clients too much, you risk losing clients and, hence, money. If you don’t charge enough, you may find yourself wondering if you hadn’t lost the client in the first place. Estimating a project accurately is critical to running a profitable construction business.

QuickBooks for construction businesses helps you estimate the cost of each phase of the process, removing the guesswork from the job.

5. Customer Support

QuickBooks’ best-in-class customer support is another huge factor in its significant popularity among business professionals. The QuickBooks Contractor Online system is highly rated, which is a huge benefit for contractors. Users can call for direct phone help, among other choices. You can also consult an online resource library or ask your query in the QuickBooks online community.

Furthermore, because QuickBooks has an extensive user base in industries other than construction, many users have created their own support resources. There are numerous websites and YouTube videos available for a brief overview or unofficial how-to instruction.

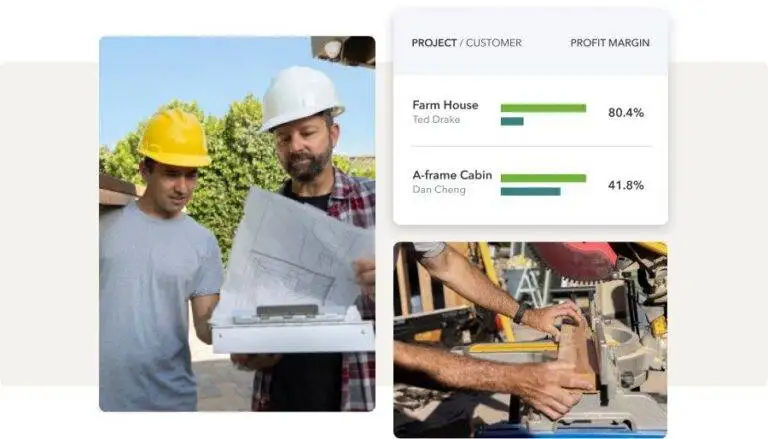

6. Tracking Project Profitability

Many contract-based firms struggle to determine whether or not their initiatives are profitable. Advanced addresses this issue by enabling you to track time and expenses for every job order as well as generate profit and job cost reports from any location. This assists you in determining which of your initiatives are lucrative and which have cost overruns.

You may isolate your hourly labor from your other project expenditures in QuickBooks Online for contractors, allowing you to better analyze your earnings from each project.

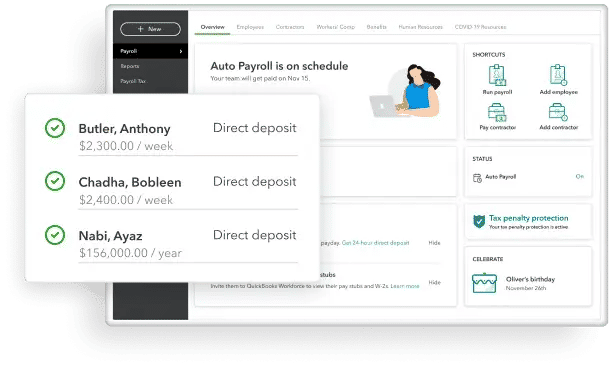

7. Managing Multiple Contractors

By automating the process of getting Form W-9 and tax ID information, QuickBooks Online enables you to handle various contractors and subcontractors. Just send an email invitation to the contractor, have them fill out their information, and you’ll have everything you need for the tax season in a matter of minutes, making 1099 reporting simple.

One of the most useful features of QuickBooks Online for construction is the ability to add up to 25 users with customizable roles and permissions so that only the appropriate individual may access and work on the appropriate content.

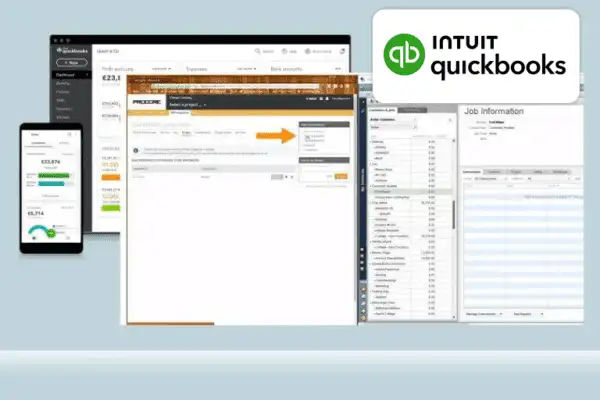

8. Integration with Construction Apps

While QuickBooks Online is an excellent accounting solution for contractors, it is not a comprehensive enterprise resource planning (ERP) system and thus, lacks contractor-specific management features. However, it seamlessly integrates with renowned construction programs like AutoEntry, Corecon, and Buildertrend. These integrated construction apps have the potential to transform Advanced into a robust accounting and construction management solution.

For example, while QuickBooks Online may manage your accounting, you can also link it with Buildertrend to execute single-entry estimating, building proposals, and bidding requests.

9. Remote Collaboration

Another advantage of QuickBooks Online is the ability to collaborate with team members from any location. Because QuickBooks is a cloud-based system, you can access your data saved on the platform from any device, at any time. This implies that project managers, supervisors, or other team members can create and assign work, make and send invoices, collect money, and clock in and out from their mobile devices.

10. Flexibility

One of the most lucrative benefits of QuickBooks Online is its flexibility. It has customizable options to suit your specific accounting needs, irrespective of your company’s size and number of projects. Finally, one more advantage of QuickBooks for construction businesses is worth mentioning. QuickBooks Online for contractors is available for free. At the very least, it’s free for a 30-day trial period.

Of course, while 30 days may not be long enough to conduct business, it may provide you with enough information to decide whether you want to pay to try it out further. You can then decide whether you’re the right size to be a QuickBooks construction contractor or if another construction accounting software product would be a better fit.

Drawbacks of QuickBooks Online

Although QuickBooks Online comes with a plethora of advantages, users sometimes report facing some drawbacks while using the software. Some of the major concerns include:

Manual Followup

Users must manually monitor due-date transactions such as invoices, payments, and deposits. Only the Advanced plan, which is six times more expensive than QuickBooks Online’s Simple Start plan, allows you to automatically route invoices via an approval procedure or inform clients of received payments.

Data Restoration

Unless they subscribe to a more expensive tier, users cannot easily restore their account data to a specified date and time. This inhibits people on a tight budget’s capacity to undo changes made to vendors, customers, or settings.

Limited Integrations

Users must subscribe to the highest plan to gain access to more difficult integrations like HubSpot, Salesforce, or DocuSign. Otherwise, companies will face difficulties in developing more customized end-to-end business solutions.

Customer Support and Training

QuickBooks Online provides online support in the form of tutorials and video courses. Nevertheless, support is more community-based, with customers having to travel to online forums to get the most immediate assistance. Training can be a bit expensive for small companies. Clearly, the major drawback of QuickBooks Online lies in its restricted access to features in the basic plan. If you can afford to sign up for an advanced subscription, none of these will be an issue. And for companies that have limited budgets and cannot afford expensive plans, the number of features available for them is still more than sufficient to get the job done on a daily basis.

Can You Use QuickBooks Online for Construction?

QuickBooks Online is the suggested accounting software for construction companies since it allows you to streamline your processes with features like job costing, scheduling, and invoicing. You can choose from four different QuickBooks Online subscriptions: Simple Start, Essentials, Plus, and Advanced.

You may use QuickBooks from anywhere as long as you have a secure login and an internet connection. Furthermore, you will never have to back up your file.

QuickBooks for general contractors is perfect since the cloud-based software works effortlessly with your construction management software.

How to Use QuickBooks Online for Contractors and Field Promax

Field Promax is a work management program that will help you optimize your business processes and work more productively while staying within your budget. It integrates with QuickBooks and allows users to transfer data between the two programs. Field Promax assists you in managing your team of field technicians by efficiently handling work orders and maintaining an up-to-date record of activities and results.

Field Promax effortlessly syncs clients and objects from QuickBooks. Create an estimate in Field Promax and then convert it to a work order. Complete and close a work order to have QuickBooks create an invoice for you.

Mistakes to Avoid When Using QuickBooks for a Construction Company

Although QuickBooks Online is an invaluable business tool for your construction company, it is critical to understand the software before proceeding with business.

Business owners frequently proceed with a project before fully comprehending how to use QuickBooks for contractors. As a result, mistakes may occur, and the software may not be used to help your organization as effectively as it could if you took the time to learn.

If you’re just starting off, it might be a good idea to have someone in charge of handling QuickBooks, someone who has some basic knowledge of accounting as well as accounting software. This reduces the possibility of errors occurring, and the software can be used as a business tool rather than a liability.

Here are some of the most common risks associated with using QuickBooks for construction projects:

- Outsourcing of payroll

- Not tracking both income and expenses

- Not receiving payment from customers correctly or on time

- Adding job costs through the accounts and/or expenses tab

- Not using an estimating tool along with QuickBooks

If hiring someone with professional expertise to use QuickBooks Online isn’t an option for you, don’t let that stop you from using it! While having someone who is good with numbers would be beneficial, you can get help for free from online forums. Alternatively, you can opt for a reliable construction business software that offers easy integration with QuickBooks. Field Promax is a leading choice in this regard.

Conclusion

Although QuickBooks Online is regarded as the best accounting software for independent contractors, it is not without shortcomings. When considering QuickBooks Online for construction, consider the following limitations:

-

Unlike the Contractor Edition on QuickBooks Desktop, it lacks construction and business-specific capabilities.

-

You cannot automatically allocate indirect costs to jobs.

-

Projects can only belong to a client or sub-customer, not to a sub-project.

-

QuickBooks Online does not provide reports such as job costs by vendors.

-

It is expensive to maintain and add features.

Today’s business environment has become more competitive and complex. So, it is important that you have the right resources to face the challenges. While QuickBooks Online is a good choice for construction companies and contractors, it may not be enough if you want to reap the full benefits of digital transformation.

To this end, you need a comprehensive automation solution that takes care of your accounting and bookkeeping needs as well. And this is exactly why Field Promax is the leading choice among contractors today. It is an all-in-one software solution for construction businesses that supports seamless QuickBooks Online integration. Moreover, it offers an efficient two-way sync between the two platforms, which enables you to use the same data for a variety of tasks. To explain, you can create estimates, manage job orders, assign field workers, schedule repeat work orders, create route plans, organize accounting and tax documents, manage bookkeeping, and generate invoices with just a few clicks without having to enter the same data in different forms. Not only does this save you time, but it also eliminates the risks of data entry errors, double booking, overcharging, undercharging, and not filling out tax details on time.

For more information, contact Field Promax

We're here to help you get started