The Best Small Business Accounting Software in 2024: Review and Comparison

.webp?updatedAt=1746791307891)

In the ever-evolving landscape of small business management, having the right accounting software tailored to your specific needs is paramount to success. With different types of desktop accounting software for small business coming out every day and promising lucrative features, it can be a hard task to stay focused. While making the decision, you must make sure the accounting software you are purchasing is compatible with your existing system.

Research indicates that three-quarters of large U.S. firms now use Apple-based digital products in their operations. However, small businesses are not far behind. More than 57.8% of small and medium businesses (SMBs) are ready to integrate Mac-based systems into their workflow.

The demand for efficient Mac-compatible accounting solutions is on the rise, as small business owners seek intuitive, feature-rich software to streamline tasks like invoicing and expense tracking. With macOS Sequoia’s enhanced Apple Intelligence—features like smarter search and improved Siri functionality—Mac users now benefit from a smoother, more optimized accounting experience. In this blog post, we delve into the realm of desktop accounting software for small businesses designed explicitly for Mac users, conducting a comprehensive review and comparison of the top contenders in 2024.

Ready to get started with Field Promax?

Sign Up FreeIn an era where efficiency and accuracy are paramount, the right small business accounting software for Mac can be a game-changer for small businesses. It’s not just about balancing the books; it’s about leveraging technology to optimize financial workflows, enhance reporting capabilities, and ultimately drive strategic decision-making.

The current market, however, is practically saturated with an overwhelming number of accounting software options. But how do you choose the right one for your business? Which software can give you the best value for your money? Which one has the best features to enhance your business processes? Where would you find the best deals? These are some of the pressing questions you must ask before you make a decision. And as expected, it would require thorough research on your part because you need to choose a small business accounting software Mac users will benefit from—not just any accounting software!

To save you the hassle, we have carefully curated a detailed comparison of the best small business accounting software for Mac. All you need to do is read the reviews carefully and figure out which software fits your needs perfectly. And then, subscribe and enjoy flawless accounting and bookkeeping services to grow your business further. So, without further ado, let’s jump in.

1. Wave

Rating: 4.5

.webp?updatedAt=1746791525189)

Overview

Wave is the best software for business owners, like sole proprietors and freelancers, who need an online accounting service and may want a little room to grow. Integrated payroll and double-entry accounting support make it a potential option for small businesses with a few employees, though there are better choices for those companies. And because it has a simple user interface, even financial novices could use it.

Review

Wave is one of only two online accounting services that you can use for free unless you need payroll and payments, which you do have to pay for. Wave follows standard accounting rules and is especially skilled at invoicing and transaction management. It’s one of the cleanest, most understandable business services available. It supports multiple currencies and allows you to pay international employees easily. It also has a smart selection of features for very small businesses. It doesn’t have a dedicated time-tracking tool, comprehensive mobile access, or inventory management, though.

Pros

- Free for those who don’t need payments or payroll

- A smart selection of features for very small businesses

- Excellent invoice and transaction management

- Great dashboard

- Multicurrency support

Cons

- Sparse record templates

- Invoice customization could be stronger

- Lacks full-service payroll for several US-state-supported formats

- Slim feature set on mobile apps

Verdict: Best for small businesses with less than 9 users.

2. Zoho Books

Rating: 4.5

.webp?updatedAt=1746792455738)

Overview

Zoho Books is a smart online accounting software solution designed to help businesses streamline their back-office operations, automate business workflows, and securely collaborate with accountants online. It is designed for all business sizes, from small businesses to large enterprises, and can be used by service, consulting, and marketing companies. The accounting solution offers a range of features, including cash flow management, invoicing, one-off or recurring invoice generation, balance sheet management, inventory management, purchase order management, expense tracking, automated workflow creation, and much more. While it’s at least as capable as some of the best of its competitors, Zoho Books is surprisingly affordable, and it even has a free version.

Review

Zoho Books is the small business accounting element of Zoho’s ecosystem of productivity applications. Your accounting data can be tightly integrated with numerous related apps and functions, like CRM, customer service, and email. Zoho Books’ usability, flexibility, and depth in standard bookkeeping areas (sales and purchases, time and project tracking, and inventory management) equal and sometimes surpass what’s offered by competitors. Overall, Zoho Books is best for businesses that use some of Zoho’s other applications, but its appeal isn’t limited to such cases. We also recommend it to small businesses, growing businesses, and established businesses that want its customizability, depth, and usability. That said, the depth of its features might be overwhelming to very small businesses but will be welcomed by companies with more advanced needs.

Pros

- Depth and flexibility in every module

- Multiple sales and expense form types

- Excellent, customizable reports

- Exceptional support options

- Integration with SurePayroll

- Great mobile app

Cons

- May be too complex for some small businesses

- Time tracking must be tied to projects

- No inventory assemblies

- Limited pool of accountant partners

Verdict: The best accounting software for large businesses. Small and medium businesses can also benefit from its wide range of features and seamless integration.

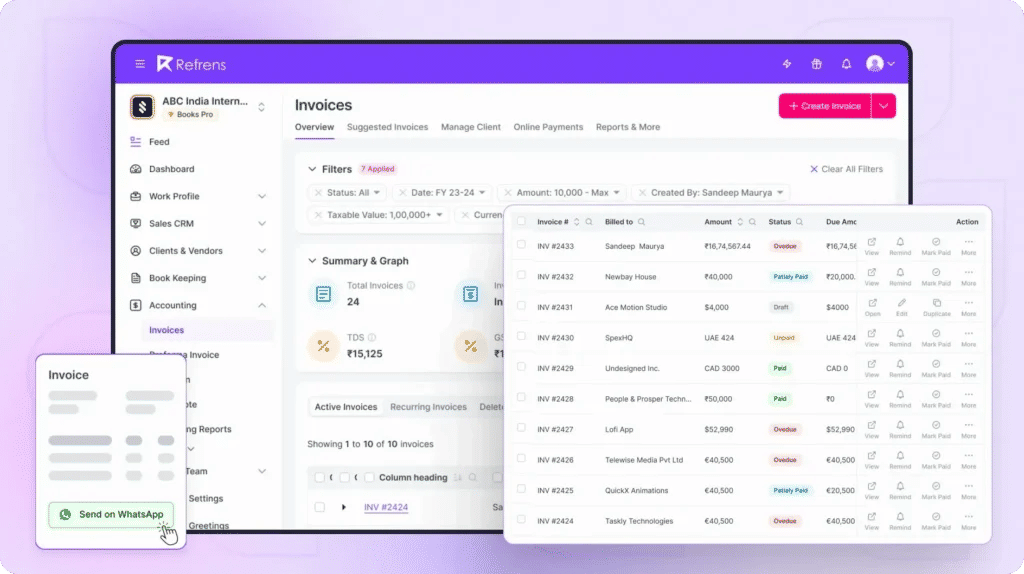

3. Refrens

Rating: 4.8

Overview

Refrens is a simple yet comprehensive accounting software trusted by over 150,000 businesses across 170 countries. It offers an all-in-one solution for invoicing, accounting, financial reporting, compliance, inventory management, expense tracking, and sales workflow management. Whether you’re a freelancer, a small business, or an enterprise, Refrens helps streamline your accounting and financial processes.

Review

Refrens stands out as one of the easiest and most affordable accounting & quotation software available. Its intuitive design simplifies tasks such as invoice creation, ledger and voucher updates, financial reporting, and payment tracking. Refrens also excels in managing expenses and quotations, providing businesses with a centralized platform for all accounting and financial needs.

Pros

- User-friendly interface, ideal for non-accountants

- Best value for money in the accounting software space

- All-in-one solution for invoicing, accounting, and quotations

- Multi-currency support and compliance with international tax systems

- Automates invoicing and payment reminders, saving time on routine tasks

Cons

- No offline access

4. Intuit QuickBooks Online

Rating: 4.5

.webp?updatedAt=1746792558959)

Overview

QuickBooks Online is a cloud-based accounting solution perfect for businesses of any size. It is the perfect accounts payable software small business owners can leverage to manage their accounting, income, expenses, payroll, and more. No additional software is required as all accounts are viewed via the online login portal, with custom feeds and charts, custom invoice creation, ‘Pay Now’ buttons, and mobile websites, all with auto-synchronization. The native mobile apps for Android and iOS facilitate on-the-go sales receipt capture, expense tracking, cash flow management, account balance tracking, time tracking, transaction review, purchase order management, client communications, and more.

Review

Intuit QuickBooks Online has been the small business accounting service to beat for many years. It puts highly effective accounting functionality into an exceptional user experience. The service stands out because it’s easily customizable, comes in multiple versions with hundreds of add-on apps, and offers better mobile access than most rivals. Intuit QuickBooks Online, however, is expensive, so it’s most appropriate for small businesses with a technology budget. It’s easy enough for an inexperienced bookkeeper to learn but feature-rich enough that a more demanding user can make use of its advanced accounting tools. Because it’s so customizable and user-friendly, it would appeal to a wide variety of business types.

Pros

Excellent user experience Dual-screen dashboard In-depth contact records and transaction forms Numerous customizable reports Supports projects, payroll, and many add-ons Great mobile apps

Cons

- Expensive

- Confusing toolbar

- Online support could be better

Verdict: The best accounting software for small business with inventory.

5. Xero

Rating: 4.3

.webp?updatedAt=1746792699148)

Overview

Xero has emerged as a game-changer in the realm of cloud-based financial management for businesses. Launched in 2006, this New Zealand-based desktop accounting software for small businesses has garnered widespread acclaim for its user-friendly interface, robust features, and seamless integration capabilities. Xero caters to a diverse range of businesses, from startups to established enterprises, providing comprehensive payroll software, invoicing, expense tracking and more. Its accessibility from any device with an internet connection makes it a flexible choice for businesses on the go.

Review

From a user’s perspective, Xero stands out for its intuitive design and user-friendly interface. Navigating through various financial tasks becomes a breeze, even for those without extensive accounting backgrounds. The platform’s real-time collaboration feature is particularly noteworthy, allowing multiple users to work simultaneously and facilitating smoother teamwork. The dashboard provides a clear snapshot of financial health, and the ability to customize reports ensures businesses can extract the precise insights they need.

Pros

- Ease of use

- Real-time collaboration

- Integration capabilities

- Automated processes

- Mobile Accessibility

Cons

- Pricing

- Learning curve

Verdict: An ideal solution for businesses looking to scale their operations.

6. FormPros

FormPros offers an intuitive and reliable solution for generating professional pay stubs through their simple pay stub generator. With a user-friendly interface, the platform ensures quick and accurate results tailored to your specific requirements. Whether you’re an employer, a contractor, or an individual needing proof of income, FormPros simplifies the process with step-by-step guidance. The service includes advanced calculations for deductions, taxes, and earnings, ensuring compliance with state and federal standards. Additionally, the platform’s seamless digital delivery allows you to access and download your pay stub instantly, making it ideal for urgent needs.

Pros

- Ease of Use

- Accuracy

- Speed

- Customization

- Accessibility

Cons

- Cost

- Limited Scope

- No Free Option

7. Quicken

Rating: 4.5

.webp?updatedAt=1746792812742)

Overview

Quicken, a household name in personal finance management, has established itself as a versatile accounting software solution. Originally designed for personal use, it has evolved to cater to small businesses and freelancers, providing a comprehensive suite of tools for financial tracking and management. With features ranging from expense tracking to budgeting and investment management, Quicken has aimed to be an all-in-one financial hub. This review will delve into its capabilities, ease of use, and overall effectiveness, offering insights into how well it serves the accounting needs of small businesses.

Review

Quicken impresses with its user-friendly interface and intuitive design, making it accessible even for those with limited accounting knowledge. The software offers a robust set of features, including the ability to link bank account, credit cards, and investment accounts, providing a real-time overview of your financial landscape. The categorization and tagging options facilitate detailed expense tracking, while the budgeting tools empower users to set and monitor financial goals effectively.

The reporting capabilities of Quicken accounting software are commendable, offering customizable reports that provide deep insights into income, expenses, and overall financial health. The ability to generate tax reports simplifies the tax preparation process, saving valuable time for small business owners. However, some users may find the learning curve steeper when venturing into more advanced features, and occasional syncing issues with certain banks have been reported.

Pros

- Comprehensive Financial Overview

- User-Friendly Interface

- Robust Reporting Features

- Tax Preparation Simplified

Cons

- Learning curve for advanced features

- Syncing Issues

Verdict: A valuable tool for managing personal and business finances.

8. Oracle NetSuite

.webp?updatedAt=1746792949747)

Overview

Oracle NetSuite stands tall as a comprehensive and cloud-based desktop accounting software for small business that has gained widespread recognition for its ability to streamline financial operations. Aimed at businesses of varying sizes, NetSuite offers an integrated suite of applications covering accounting, financial management, customer relationship management (CRM), and more. Its cloud-based nature ensures accessibility from anywhere, facilitating real-time collaboration and data-driven decision-making. As part of the Oracle ecosystem, NetSuite brings a robust and scalable solution to the table, promising a holistic approach to business management.

Review

Users consistently praise Oracle NetSuite for its user-friendly interface and the seamless integration of diverse functionalities. The platform provides a unified view of financial data, making it easier for businesses to monitor and manage their financial health. The customizable dashboards empower users to tailor the system to their specific needs, enhancing the overall user experience. Real-time reporting capabilities are often highlighted, allowing for quick and informed decision-making. However, some users have reported a steeper learning curve, particularly for advanced features, which might require additional training for optimal utilization.

Pros

- Comprehensive Integration

- Scalability

- Real-time Reporting

- Cloud-Based Accessibility

Cons

- Learning Curve

- Cost

- Customization Complexity

Verdict: Best for global businesses.

9. Melio

Rating: 4.3

.webp?updatedAt=1746792976368)

Overview

Melio is a cloud-based accounting software solution that has gained traction for its user-friendly interface and robust features tailored for small and medium-sized businesses. Launched with the aim of simplifying payment processes, Melio goes beyond basic accounting functions, offering a comprehensive platform for managing payables and receivables. Designed to enhance efficiency and reduce the complexity of financial transactions, Melio integrates seamlessly with various accounting tools, making it a promising choice for businesses looking to streamline their payment workflows.

User Review

Users of Melio consistently praise the platform for its intuitive design and straightforward functionality. The software provides a centralized hub for managing vendor payments and invoicing, allowing users to schedule payments, track expenses, and automate routine financial tasks. The dashboard’s simplicity stands out, providing a quick overview of pending payments and outstanding invoices. Additionally, the ability to sync Melio with existing accounting software ensures a smooth transition for businesses already utilizing specific accounting tools.

Pros

- User-Friendly Interface

- Efficient Payment Management

- Integration Capabilities

- Multi-User Collaboration

Cons

- Limited Advanced Features

- Transaction Processing Time

Verdict: Ideal for businesses with multiple teams.

10. Financial Cents

Rating: 4.3

Review

Financial Cents is a modern, cloud-based practice management solution built specifically for accounting firms looking to streamline their workflows, improve team collaboration, and never miss a client deadline. Designed for both solo practitioners and growing teams, it offers powerful tools such as automated recurring tasks, deadline reminders, real-time collaboration, and advanced reporting.

With its simple, intuitive interface, Financial Cents makes it easy to assign tasks, track project progress, manage client communications, and store critical documents securely in one central location. The software also includes built-in productivity tracking and insightful reporting to help firms optimize operations and confidently meet every deadline.

Financial Cents provides a purpose-built, scalable solution tailored exclusively for accounting professionals if you're tired of retrofitting generic project management tools.

Pros

- Built specifically for accounting, bookkeeping and tax professionals

- Automated recurring tasks and deadline tracking

- Real-time team collaboration features

- Centralized document and client management

- Workflow templates and productivity reporting

- Simple, intuitive interface for easy onboarding

Cons

- No mobile app (yet)

- Not designed for payroll management

Verdict: The best practice management solution for accounting firms focused on improving efficiency, meeting deadlines, and easily scaling their business.

Final Words

For more information, contact Field Promax

We're here to help you get started

In the realm of small business accounting, the quest for efficiency and automation is paramount. To achieve this, try testing out some of these highly-rated accounting tools, and for additional help consider tapping into a reputable talent marketplace such as Toptal, where you can hire dedicated freelance CPAs. By leveraging these platforms, businesses can seamlessly integrate the latest accounting tools, aligning with the trends and predictions shaping the future of small business accounting.

As you are looking for the perfect Mac-compatible desktop accounting software for small business, why not do it for all the other aspects of your business as well? To put it in simpler words, business software solutions designed exclusively for Mac-based systems can give you the extra edge that these Mac-based accounting software solutions will provide you. And the best choice in this regard is Field Promax. Additionally, remember to run maintenance on Mac regularly to ensure that all software, including your accounting tools, operates smoothly and efficiently.

Field Promax stands out as the go-to solution for field service businesses operating on Mac-based systems, offering a seamless and tailored experience for managing on-field operations. With its Mac-compatible design, Field Promax ensures that users on Apple devices can effortlessly harness the power of this field service management software without any compatibility issues. The intuitive interface aligns with the sleek Mac aesthetics, providing a user-friendly experience that minimizes the learning curve for technicians and field service personnel. From scheduling appointments to dispatching technicians, tracking inventory, and generating reports, Field Promax’s Mac compatibility ensures that businesses can optimize their field service operations effortlessly, leveraging the power of their Mac systems to enhance overall efficiency.

Moreover, Field Promax goes beyond streamlining field operations by seamlessly integrating with accounting and bookkeeping processes, making it a holistic solution for business management. Mac users can now centralize their accounting tasks on the same platform, eliminating the need for multiple software applications. Field Promax’s accounting and bookkeeping features empower businesses to manage invoices, track expenses, and handle financial transactions with ease. The integration ensures real-time synchronization between field service operations and financial data, providing businesses with a comprehensive overview and enabling them to make informed decisions for sustainable growth. By choosing Field Promax, Mac-based field service businesses not only optimize their on-field activities but also establish a robust system for efficient accounting and bookkeeping.

So, why wait? Sign up now to explore the myriad of benefits of Field Promax.