How Much Does It Cost to Register Your Field Service Business? A Complete Guide

One of the most important steps you’ll take in the life of your field service business is to officially register it as a Limited Liability Company, or LLC. While registration is not legally mandatory, it can yield countless benefits, from personal wealth protections to a general increase in business credibility.

One of the many perks of the LLC format is that registering is both relatively quick and relatively inexpensive. Even so, it may be helpful to learn a little more about what the process entails, and how much it stands to cost you.

What is an LLC?

Before we get into the logistics of LLC registration, along with questions about cost, it may be helpful to define the term.

The LLC is one of several legal formulations you can choose for your field service business. To understand what makes it so advantageous, it’s important to understand some broader context.

Let’s say you set up shop as a plumber, working solo and addressing plumbing needs in your local community. By default, the government will consider you to be a Sole Proprietor. Basically this means that you are solely responsible for running your business and making all the decisions. It also means that all revenues, along with all losses and liabilities, fall to you.

Running your field service business as a Sole Proprietorship is incredibly simple, but it also carries some risk. If anyone sues you, there’s no way to protect your personal or family assets. And in a litigious industry like plumbing, HVAC, or home remodeling, that can be a pretty significant risk.

When you register your business as an LLC, however, you actually establish it as its own distinct legal entity, with its own separate assets and liabilities. This yields a number of important benefits.

Why Register Your Field Service Company as an LLC?

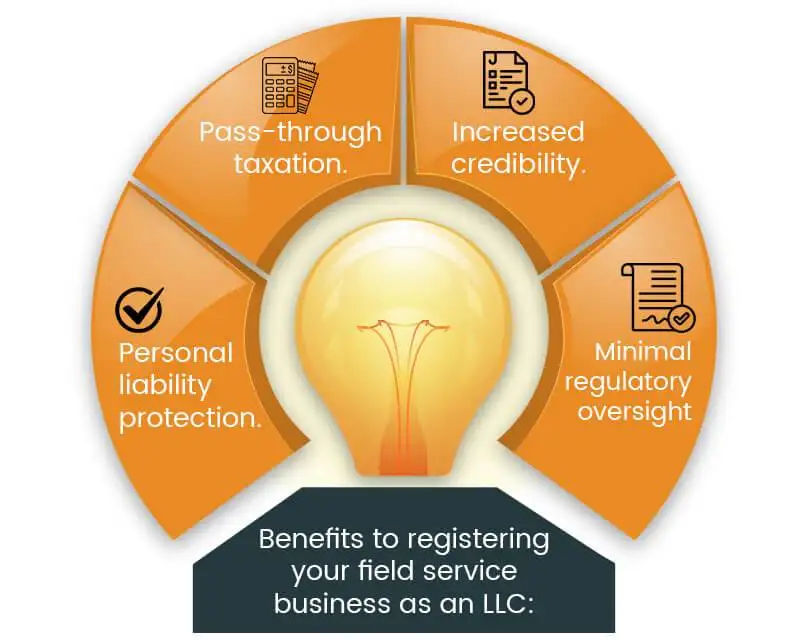

Consider just a few of the benefits to registering your field service business as an LLC:

-

Personal liability protection. The LLC format lets you keep business assets and liabilities separate from your personal ones, which means you can minimize your personal risk exposure in the face of litigation or aggressive creditors.

-

Pass-through taxation. Registering your business as an LLC allows you to claim pass-through taxation, which simply means that you declare profits and losses on a personal return as opposed to filing a separate business return. However, you may be wondering, can you file LLC taxes separate from personal? The answer depends on your LLC’s structure; single-member LLCs report business income on their personal taxes, while multi-member LLCs can file separately.

-

Increased credibility. Going to the trouble of registering your business confers professional credibility, which can make it easier for potential customers to take you seriously. It may also make it easier to secure favorable terms for business loans or lines of credit.

-

Minimal regulatory oversight. Compared with other formulations, like the Corporation, LLCs come with only the most modest of compliance considerations. Generally speaking, establishing and administering an LLC is fairly easy, allowing you to focus most of your time on leading your team and serving your customers.

These are just some of the reasons why the registration process is worthwhile for your field service company.

What are the Steps for Registering Your Field Service Business as an LLC?

Before we come to the question of cost for LLC registration, it’s important to understand the basic steps involved in this process.

It’s important to be aware that the process for registering your business as an LLC can vary depending on which state you’re in. You’ll always want to double-check local statutes, perhaps reaching out to the local Chamber of Commerce for guidance. With that said, the process for registering an LLC usually goes something like this.

1. Decide which state to register in.

Technically, you’re allowed to register your LLC in the state of your choosing. The question is, is it best to just stick with your home state, or is there any advantage to “shopping around” for the best LLC environment?

For field service companies, it’s almost always best to just register wherever you’re serving homeowners. Note that, if you’re near state lines and serve clients in multiple jurisdictions, it may be necessary to register your LLC in two states. But for most small businesses, the decision of where to register should be pretty straightforward.

2. Land on a name for your LLC.

It’s legally mandatory for your LLC to have an original name… which is to say, a name that’s not already in use by another LLC in the same state.

This is usually pretty easy to ascertain. In most states, there is a readily available, searchable directory, allowing you to determine whether the name you want is still up for grabs.

3. Find a Registered Agent.

It is legally mandatory for every LLC to have a Registered Agent. What is a Registered Agent? Essentially, this can be either an individual or an organization, formally appointed to receive legal correspondence on behalf of your business. This includes tax documents as well as subpoenas or legal summons. A few things to keep in mind as you choose a Registered Agent:

- Your Registered Agent must have a physical mailing address in your state of registration. A P.O. Box won’t work.

- While some states will allow you to serve as your own Registered Agent, this is the exception rather than the rule. Remember to check local guidelines!

- You can also hire third-party Registered Agent services, which is often the simplest solution. The cost can sometimes be under $100 annually.

4. File Articles of Organization.

Needless to say, registering a new legal entity requires some paperwork. Specifically, you’ll need to file Articles of Organization with your Secretary of State. You can check sites like LegalZoom for an example of what these documents might look like. Expect your state to ask for information like your mission/purpose, contact information, and the name of your Registered Agent. When you file Articles of Organization, you’ll also be required to file an LLC registration fee. While the amount can vary from state to state, the typical cost is between $30 and $300.

5. Create an Operating Agreement

Another document to consider for your field service business is an Operating Agreement. While this document is not required by law, it can be helpful in allowing you to skirt potential tension down the road. An Operating Agreement clarifies how you’ll actually operate the business day-to-day, especially with respect to any business partners. Specifically, you’ll use your Operating Agreement to address questions like:

- How will you and your business partners allocate profits?

- How will you and your business partners allocate managerial duties and responsibilities?

- How will you handle the departure of a partner?

- What if you want to bring a new partner on board?

Again, having this document in place can help you avoid legal spats with your business partners down the road. You can find examples of this document online, at LegalZoom and similar sites.

6. Get an EIN

Every field service business should have its own employee identification number, or EIN. This is basically like an SSN, but for a business as opposed to an individual. You can claim this number for free from the IRS. You won’t necessarily need it on day one of your new business, but you will need it before you file taxes or administer payroll.

7. Set up a bank account.

Finally: To ensure you’re keeping your personal and business assets safe and separate, be sure you set up a business bank account that’s not connected to any personal savings or checking account.

How Much Does it Cost to Register Your Business as an LLC?

This process is pretty straightforward overall, and doesn’t require a lot of startup money. With that said, there may be some expenses associated with registering your LLC.

The main expense is going to be the registration fee itself. Again, this can vary from one state to the next, and the range of possible costs is $30 or so to a full 300 bucks.

You may also spend money to hire a Registered Agent. Again, prices vary, but you can potentially get an Agent for as little as $100 annually.

In some cases, you may have to pay legal fees for any attorney who helps you put together your legal documents. The LLC registration process is meant to be easy, though, which likely means you can pull it off without the need for hiring a lawyer.

For Field Service Companies, LLC Registration Can Be a Boon

Registering your field service company as an LLC isn’t simply another legal hoop to jump through. There are meaningful benefits your business can expect, including:

- Tax benefits

- Personal liability protections

- Easier options for loans and lines of credit

- Enhanced professional reputation

- Ease of maintenance

The process for registering is usually pretty simple, and also cost-effective. Use the guidelines offered here as a jumping-off point for your LLC registration process.